Tamil Nadu Board 12th Standard Accountancy - Unit 6: Book Back Answers and Solutions

This post covers the book back answers and solutions for Unit 6 – from the Tamil Nadu State Board 12th Standard Accountancy textbook. These detailed answers have been carefully prepared by our expert teachers at KalviTips.com.

We have explained each answer in a simple, easy-to-understand format, highlighting important points step by step under the relevant subtopics. Students are advised to read and memorize these subtopics thoroughly. Once you understand the main concepts, you’ll be able to connect other related points with real-life examples and confidently present them in your tests and exams.

By going through this material, you’ll gain a strong understanding of Unit 6 along with the corresponding book back questions and answers (PDF format).

Question Types Covered:

- 1 Mark Questions: Choose the correct answer,

- 2 Mark Questions: Very Short Answer Questions

- 3, 4, and 5 Mark Questions: Short Answer Questions, Excercises

All answers are presented in a clear and student-friendly manner, focusing on key points to help you score full marks.

All the best, Class 12th students! Prepare well and aim for top scores. Thank you!

Topic: Unit 6 : Retirement and death of a partner

I. Choose the correct Answer

(a) End of the current accounting period

(b) End of the previous accounting period

(c) Date of his retirement

(d) Date of his final settlement

Answer Key:

(c) Date of his retirement

(a) New profit sharing ratio

(b) Old profit sharing ratio

(c) Gaining ratio

(d) Sacrificing ratio

Answer Key:

(b) Old profit sharing ratio

(a) Capital account of all the partners

(b) Revaluation account

(c) Capital account of the continuing partners

(d) Memorandum revaluation account

Answer Key:

(a) Capital account of all the partners

(a) Gain

(b) Loss

(c) Profit

(d) None of these

Answer Key:

(b) Loss

(a) To transfer revaluation profit or loss

(b) To distribute accumulated profits and losses

(c) To adjust goodwill

(d) None of these

Answer Key:

(c) To adjust goodwill

(a) Bank A/c

(b) Retiring partner’s capital A/c

(c) Retiring partner’s loan A/c

(d) Other partners’ capital A/c

Answer Key:

(c) Retiring partner’s loan A/c

(a) A’s capital account

(b) A’s loan account

(c) A’s Executor’s account

(d) A’s Executor’s loan account

Answer Key:

(d) A’s Executor’s loan account

(a) Rs. 20,000 and Rs. . 10,000

(b) Rs. 8,000 and Rs. 4,000

(c) Rs. 10,000 and Rs. 20,000

(d) Rs. 15,000 and Rs. 15,000

Answer Key:

(b) Rs. 8,000 and Rs. 4,000

(a) 4:3

(b) 3:4

(c) 2:1

(d) 1:2

Answer Key:

(c) 2:1

(a) Rs. 1,000

(b) Rs. 3,000

(c) Rs. 12,000

(d) Rs. 36,000

Answer Key:

(b) Rs. 3,000

II.Very short answer questions

- When a partner leaves from a partnership firm, it is known as retirement. The reasons for the retirement of a partner may be illness, old age, better opportunity elsewhere, disagreement with other partners, etc.

- T he continuing partners may gain a portion of the share of profit of the retiring partner. The gain may be shared by all the partners or some of the partners.

- Share gained = New share – Old share

- Gaining ratio = Ratio of share gained by the continuing partners

- The purpose of finding the gaining ratio is to bear the goodwill to be paid to the retiring partner.

- Share gained = New share – Old share

- Gaining ratio = Ratio of share gained by the continuing partners

|

Date

|

Particulars

|

L.F

|

Debit

|

Credit

|

|

|

Deceased partner’s capital A/c Dr. To Deceased partner’s executor A/c |

|

xxx |

xxx |

III.Short questions

- Distribution of accumulated profits, reserves and losses

- Revaluation of assets and liabilities

- Determination of new profit-sharing ratio and gaining ratio

- Adjustment for goodwill

- Adjustment for current year’s profit or loss up to the date of retirement

- Settlement of the amount due to the retiring partner

|

Basis

|

Sacrificing ratio

|

Gaining ratio

|

|

1. Meaning |

It is the proportion of the profit which is sacrificed by the old partners in favour of a new partner. |

It is the proportion of the profit which is gained by the continuing partners from the retiring partner. |

|

2. Purpose |

It is calculated to determine the amount to be adjusted towards goodwill for the sacrificing partners. |

It is calculated to determine the amount to be adjusted towards goodwill for the gaining partners. |

|

3. Time of calculation |

It is calculated at the time of admission of a new partner. |

It is calculated at the time of retirement of a partner. |

|

4. Method of calculation |

Sacrificing ratio = Old profit sharing ratio – New profit sharing ratio |

Gaining ratio = New profit sharing ratio - Old profit sharing ratio |

- Paying the entire amount due immediately in cash

- Transfer the entire amount due, to the loan account of the partner

- Paying part of the amount immediately in cash and transferring the balance to the loan account of the partner.

IV. Excercises

Dheena, Surya and Janaki are partners sharing profits and losses in the ratio of 5:3:2. On 31.3.2018, Dheena retired. On the date of retirement, the books of the firm showed a reserve fund of ₹ 50,000. Pass journal entry to transfer the reserve fund.

Answer Key:

Rosi, Rathi and Rani are partners of a firm sharing profits and losses equally. Rathi retired from the partnership on 1.1.2018. On that date, their balance sheet showed accumulated loss of ? 45,000 on the asset side of the balance sheet. Give the journal entry to distribute the accumulated loss.

Answer Key:

Akash, Mugesh and Sanjay are partners in a firm sharing profits and losses in the ratio of 3:2:1. Their balance sheet as on 31st March, 2017 is as follows:

%20%20-%20English%20Medium%20Guides.png)

Question 4.

Roja, Neela and Kanaga are partners sharing profits and losses in the ratio of 4:3:3. On 1st April 2017, Roja retires and on retirement, the following adjustments are agreed upon:

(i) Increase the value of building by ₹ 30,000.

(ii) Depreciate stock by ₹ 5,000 and furniture by ₹ 12,000.

(iii) Provide an outstanding liability of ₹ 1,000 Pass journal entries and prepare revaluation account.

Answer Key:

%20%20-%20English%20Medium%20Guides.png)

Vinoth, Karthi and Pranav are partners sharing profits and losses in the ratio of 2:2:1. Pranav retires from partnership on 1st April 2018. The following adjustments are to be made:

(i) Increase the value of land and building by RS 18,000

(ii) Reduce the value of machinery by RS 15,000

(iii) A provision would also be made for outstanding expenses for RS 8,000.

Give journal entries and prepare revaluation account.

Answer Key:

Question 6.

Chandru, Vishal, and Ramanan are partners in a firm sharing profits and losses equally. Their balance sheet as of 31st March 2018 is as follows:

Ramanan retired on 31 st March 2019 subject to the following conditions:

(ii) Value of furniture brought down by ₹10,000

(iii) Provision for doubtful debts should be increased to ₹5,000

(iv) Investment of ₹30,000 not recorded in the books is to be recorded now.

Pass necessary journal entries and prepare revaluation account and capital account of partners.

Answer Key:

%20%20-%20English%20Medium%20Guides.png)

Question 7.

Kayal, Mala and Neela are partners sharing profits in the ratio of 2:2:1. Kayal retires and the new profit sharing ratio between Nila and Neela is 3:2. Calculate the gaining ratio.

Answer Key:

Sunil, Sumathi and Sundari are partners sharing profits in the ratio of 3:3:4. Sundari retires and her share is taken up entirely by Sunil. Calculate the new profit sharing ratio and gaining ratio.

Answer Key:

Ramu, Somu and Gopu are partners sharing profits in the ratio of 3:5:7. Gopu retires and the share is purchased by Ramu and Somu in the ratio of 3:1. Find the new profit sharing ratio and gaining ratio.

Answer Key:

Navin, Ravi and Kumar are partners sharing profits in the ratio of 1/2,1/4 and 1/4 respectively, Kumar retires and his share is taken up by Navin and Ravi equally. Calculate the new profit sharing ratio and gaining ratio.

Answer Key:

Mani, Gani and Soni are partners sharing the profits and losses in the ratio of 4:5:6. Mani retires from the firm. Calculate the new profit sharing ratio and gaining ratio.

Answer Key:

Rajan, Suman and Jegan were partners in a firm sharing profits and losses in the ratio of 4:3:2. Suman retired from partnership. The goodwill of the firm on the date of retirement was valued at ₹ 45,000. Pass necessary journal entries for goodwill on the assumption that the fluctuating capital method is followed.

Answer Key:

Question 13.

Balu, Chandru, and Nirmal are partners in firms sharing profits and losses in the ratio of 5:3:2. On 31st March 2018, Nirmal retires from the firm. On the date of Nirmal’s retirement, goodwill appeared in the books of the firm at Rs. 60,000. By assuming fluctuating capital account, pass the necessary journal entry if the partners decide to

(a) write off the entire amount of existing goodwill

(b) write off half of the existing goodwill.

Answer Key:

Question 14.

Rani, Jaya and Rathi are partners sharing profits and losses in the ratio of 2:2:1. On 31.3.2018, Rathi retired from the partnership. Profit of the preceding years is as follows: 2014: 10,000; 2015: RS 20,000; 2016: RS 18,000 and 2017: RS 32,000

Find out the share of profit of Rathi for the year 2018 till the date of retirement if

(a) Profit is to be distributed on the basis of the previous year’s profit

(b) Profit is to be distributed on the basis of the average profit of the past 4 years Also pass necessary journal entries by assuming partners capitals are fluctuating.

Answer Key:

(a) If the profit is to be distributed on the basis of previous year profit (2017) Rathi’s share distributed 3 months =

|

Year

|

Profit

|

|

2014

2015

2016

2017

|

10,000

20,000

18,000

32,000

|

|

Total

Profit

|

80,000

|

|

Date

|

Particulars

|

L.F.

|

Debit

|

Credit

|

|

|

Profit and

loss suspense A/c

To Rathi's Capital A/c

(Rathi's

current year share of profit credited to her capital A/c)

|

|

4,000

|

4,000

|

Question 15.

Kavin, Madhan, and Ranjith are partners sharing profits and losses in the ratio of 4:3:3, respectively. Kavin retires from the firm on 31st December 2018. On the date of retirement, his capital account shows a credit balance of Rs. 1,50,000. Pass journal entries if:

(a) The amount due is paid off immediately.

(b) The amount due is not paid immediately.

(c) Rs. 1,00,000 is paid and the balance in the future.

Question 16.

Manju, Charu and Lavanya are partners in firms sharing profits and losses in the ratio of 5:3:2. Their balance sheet as of 31st March 2018 is as follows:

(i) Stock to be depreciated by Rs. 10,000

(ii) Provision for doubtful debts to be created for Rs. 3,000.

(iii) Buildings to be appreciated by Rs. 28,000

Prepare revaluation account and capital accounts of partners after retirement.

Answer Key:

%20%20-%20English%20Medium%20Guides.png)

Question 17.

Kannan, Rahim, and John are partners in a firm sharing profit and losses in the ratio of 5:3:2. The balance sheet as on 31st December 2017 was as follows:

(i) To appreciate building by 10%

(ii) Stock to be depreciated by 5%

(iii) To provide Rs. 1,000 for bad debts

(iv) An unrecorded liability of Rs. 8,000 have been noticed

(v) The retiring partner shall be paid immediately

Prepare revaluation account, partners’ capital account and the balance sheet of the firm after retirement.

Answer Key:

%20%20-%20English%20Medium%20Guides.png)

Saran, Arun and Karan are partners in firm sharing profits and losses in the ratio of 4:3:3. Their balance sheet as of 31.12.2016 was as follows:

(i) Goodwill of the firm is valued at Rs. 21,000

(ii) Machinery to be appreciated by 10%

(iii) Building to be valued at Rs. 80,000

(iv) Provision for bad debts to be raised to Rs. 2,000

(v) Stock to be depreciated by Rs. 2,000

(vi) Final amount due to Karan is not paid immediately

Prepare the necessary ledger accounts and show the balance sheet of the firm after retirement.

Answer Key:

%20%20-%20English%20Medium%20Guides.png)

%20%20-%20English%20Medium%20Guides.png)

Rajesh, Sathish and Mathan are partners sharing profits and losses in the ratio of 3:2:1 respectively. Their balance sheet as on 31.3.2017 is given below.

(i) Rajesh and Sathish will share profits and losses in the ratio of 3:2

(ii) Assets are to be revalued as follows: Machinery Rs. 4,50,000, Stock Rs. 2,90,000, Debtors Rs. 1,52,000.

(iii) Goodwill of the firm is valued at Rs. 1,20,000

Prepare necessary ledger accounts and the balance sheet immediately after the retirement of Mathan.

%20%20-%20English%20Medium%20Guides.png)

%20%20-%20English%20Medium%20Guides.png)

%20%20-%20English%20Medium%20Guides.png)

Janani, Janaki, and Jamuna are partners sharing profits and losses in the ratio of 3:3:1 respectively. Janaki died on 31st December 2017. The final amount due to her showed a credit balance of ₹ 1,40,000. Pass journal entries if,

(a) The amount due is paid off immediately.

(b) The amount due is not paid immediately.

(c) Rs. 75,000 is paid and the balance in the future.

Answer Key:

Question 21.

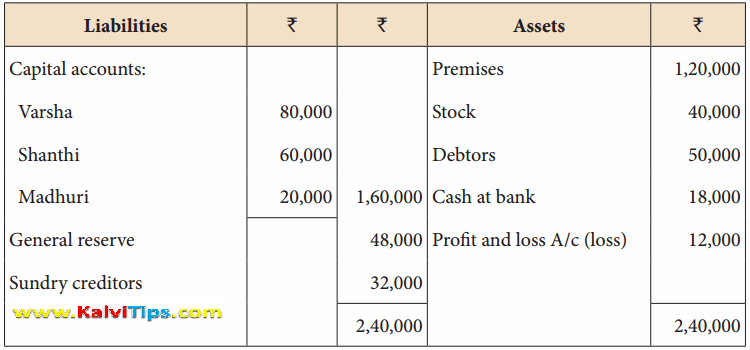

Varsha,

Shanthi and Madhuri are partners, sharing profits in the ratio of

5:4:3. Their balance sheet as on 31st December 2017 is as under:

Balance Sheet as on 31st December 2017

%20%20-%20English%20Medium%20Guides.png)

%20%20-%20English%20Medium%20Guides.png)

Vijayan, Sudhan and Suman are partners who share profits and losses in their capital ratio. Their balance sheet as on 31.12.2018 is as follows:

Balance Sheet as on 31.12.2018

(i) Building is to be valued at Rs. 1,00,000

(ii) Stock to be depreciated by Rs. 5,000

(iii) Goodwill of the firm is valued at Rs. 36,000

(iv) Share of profit from the closing of the last financial year to the date of death on the basis of the average of the three completed years’ profit before death.

Profit for 2016, 2017 and 2018 were Rs. 40,000, Rs. 50,000 and Rs. 30,000, respectively.

Prepare the necessary ledger accounts and the balance sheet immediately after the death of Suman.

Answer Key:

Profit-Sharing Ratio:

%20%20-%20English%20Medium%20Guides.png)

%20%20-%20English%20Medium%20Guides.png)

%20%20-%20English%20Medium%20Guides.png)

PG ASST IN COMMERCE

VIVEKANANDA HR SEC SCHOOL

THIRUVEDAKAM WEST

MADURAI

CONT NO 7708141076

%20%20-%20English%20Medium%20Guides.png)

0 Comments:

Post a Comment